Table of Contents

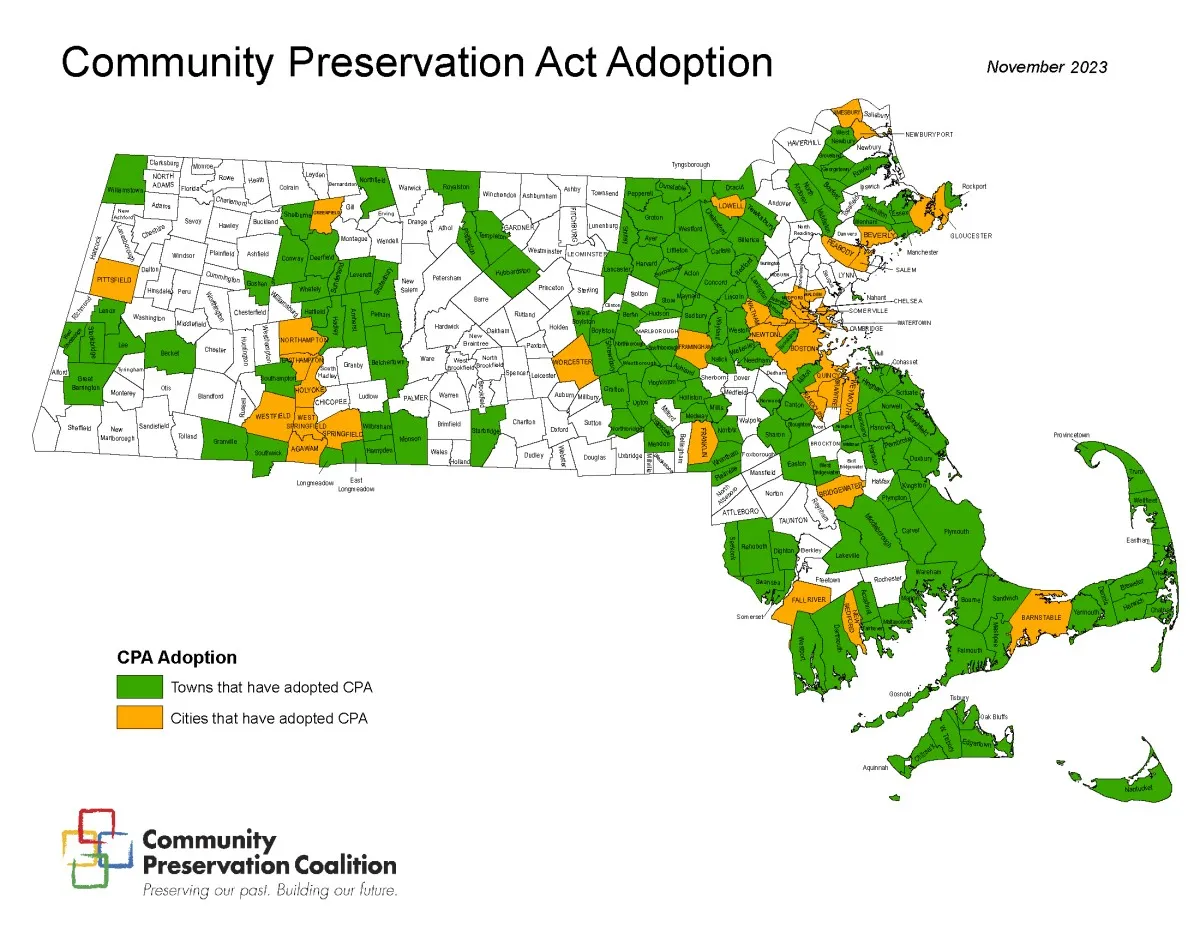

The Community Preservation Act (CPA) will be on the Town Meeting warrant for this spring. It was previously put to Town Meeting for a vote to allow it to move to town-wide ballot through a citizen petition, but failed to pass at the time.

This time, the Select Board is the proponent of the warrant article and the board is looking to have the CPA approved for town-wide ballot for the November presidential election.

The CPA Study Committee, which includes co-chairs Anthea Brady and Michael Bettencourt from the Select Board, voted on March 11 to approve a 1.5% surcharge (which is not to exceed 3%) and three common exemptions from the CPA surcharge.

The CPA Study Committee is also working to finalize a report sometime in early April, ahead of Town Meeting.

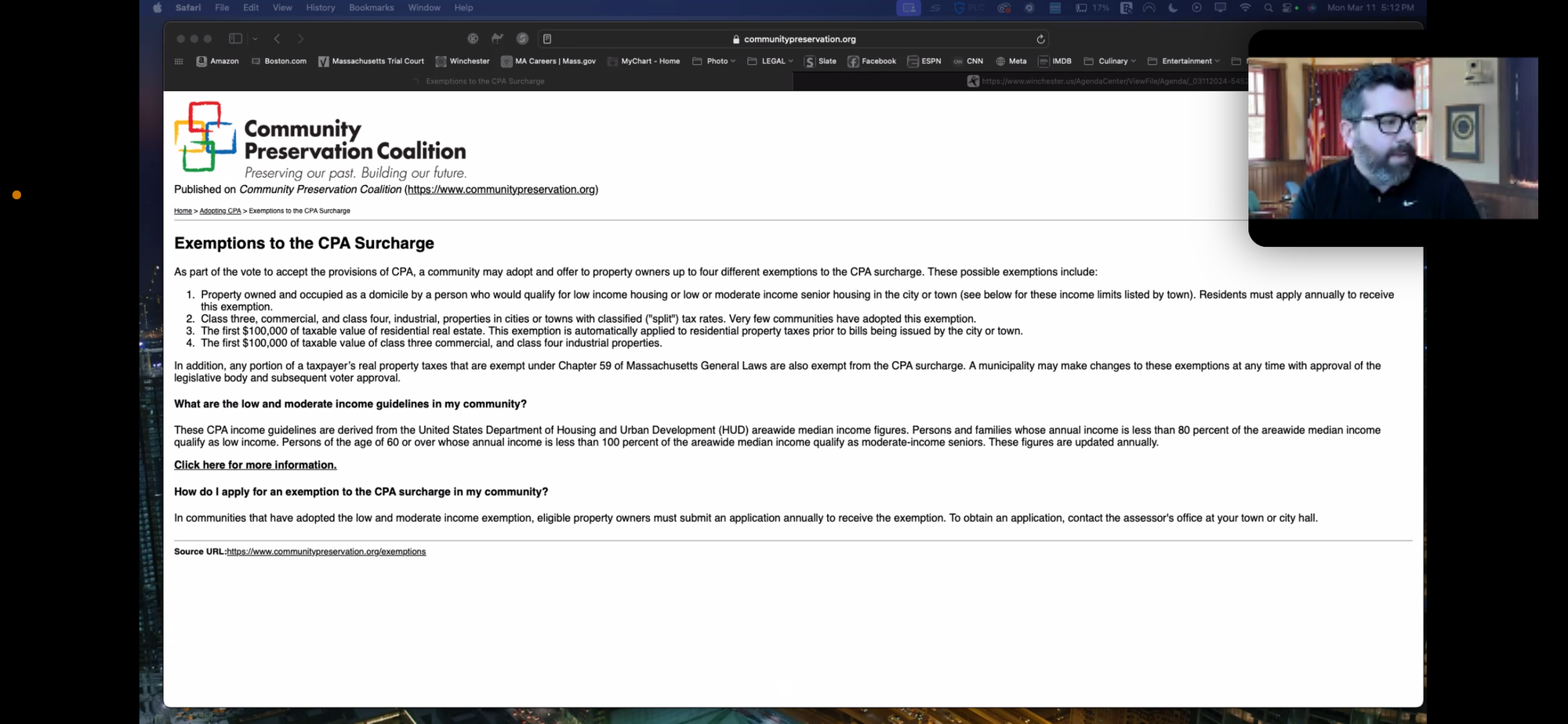

The approved exemptions protect low income and low-to-moderate income seniors and the first $100,000 of taxable property value. One exemption allows for those who would qualify for low-income housing and low-to-moderate income senior housing in Winchester to be exempt from the surcharge.

This exemption needs to be applied for annually (applications will be available through the assessor’s office if it passes) and follows the HUD area median income (AMI) guidelines. The other two exemptions allow the first $100,000 of taxable value of both residential real estate and commercial and industrial real estate to be exempt. These two exemptions are automatic.

The surcharge amount and approved exemptions were presented to the Select Board at the March 11 meeting and were added to the CPA warrant article, which was approved. The warrant closed on March 15 at noon.

Communitypreservation.org states, “The Community Preservation Act (CPA) is a smart growth tool that helps communities preserve open space and historic sites, create affordable housing, and develop outdoor recreational facilities.”

Click here to search the CPA Project Database for projects in surrounding communities.

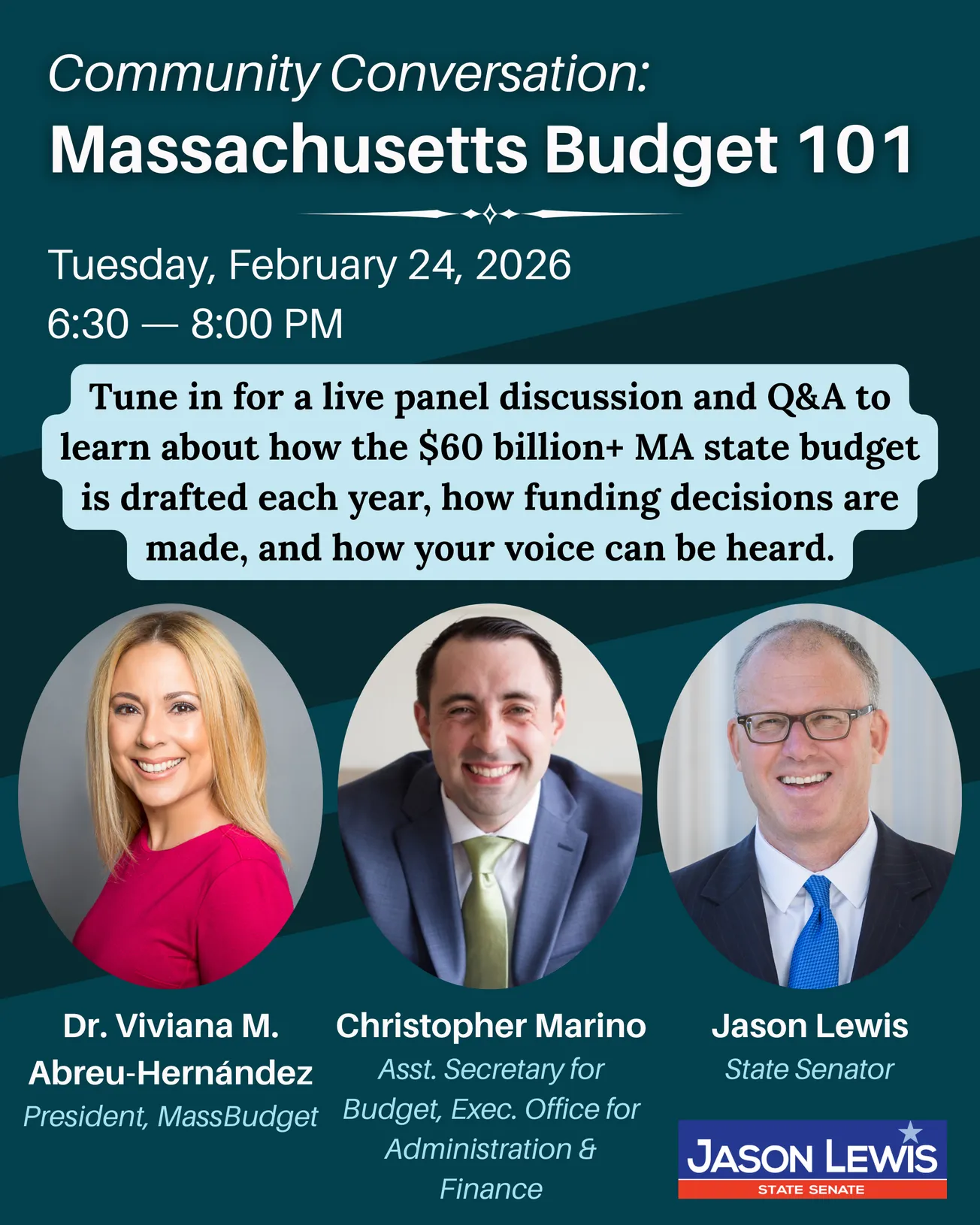

Per the CPA statute, cities and towns must adopt the CPA by ballot referendum and create a Community Preservation Fund. The money for the fund is then raised through a surcharge of the tax levy against real property. The CPA surcharge does not raise the tax rate for the community but assesses a surcharge on property tax bills after they have been calculated (calculation based on the community’s current tax rate).

Each CPA community must also establish a local Community Preservation Committee (CPC) upon adoption of the CPA. This is a five to nine member board, which makes recommendations regarding CPA projects to the community’s legislative body. In Winchester the legislative body is Town Meeting.

Town Meeting must approve CPA fund appropriations. The Select Board hopes to present a draft bylaw or bylaw example creating the CPC to Town Meeting in the spring, but the bylaw will not be presented for approval by Town Meeting until the fall if the CPA passes on the town-wide ballot on Nov. 5.

The CPA statute also created a statewide Community Preservation Trust Fund. This fund is administered by the Department of Revenue (DOR) and provides distributions each year to CPA communities at a variable rate (21.02% in 2023). The distributions serve as an incentive for communities to pass the CPA.

Trust Fund revenues come from a surcharge on all real estate transactions at the Registries of Deeds. The surcharge for most documents is $50. However, municipal lien certificates are subject to a $25 surcharge. Therefore, all communities pay into the fund (through real estate transactions), but only those which pass the CPA receive distributions.

Communitypreservation.org states that “until CPA was enacted, there was no steady funding source for preserving and improving a community's character and quality of life. The Community Preservation Act gives a community the funds needed to control its future.”

In addition to CPA funding, communities can obtain funding through both bonding and leveraging. Bonding is more costly since like any loan interest is charged. However, bonding against future CPA funds can be a useful tool to accomplish community preservation projects with a larger price tag.

Many municipalities also use their CPA funds to leverage additional funds from state and federal grant programs, other local funds, non-profit organizations and/or private entities for certain projects.

For more information on the CPA, visit www.communitypreservation.org.

CPA by the numbers in Winchester

Estimates presented by the town of Winchester.

● 1.5%-the surcharge recommended for Winchester

● $1.5 million-the average single family home value for Winchester in fiscal year 2024

● $236-the tax impact based on FY24 average single family home value (tax impact to actually occur in FY2026)

● $1.53 million-Projected CPA revenue at 1.5% surcharge in Year 1 (assumes exemptions for low-income and $100,000 off residential assessment and all commercial & industrial properties)

● $306,259-CPA match at 20% the following fiscal year (based on most recent match)

Winchester News is supported by our community. Please donate to support our work.