Table of Contents

An occasional column about town activities

by Tara Hughes

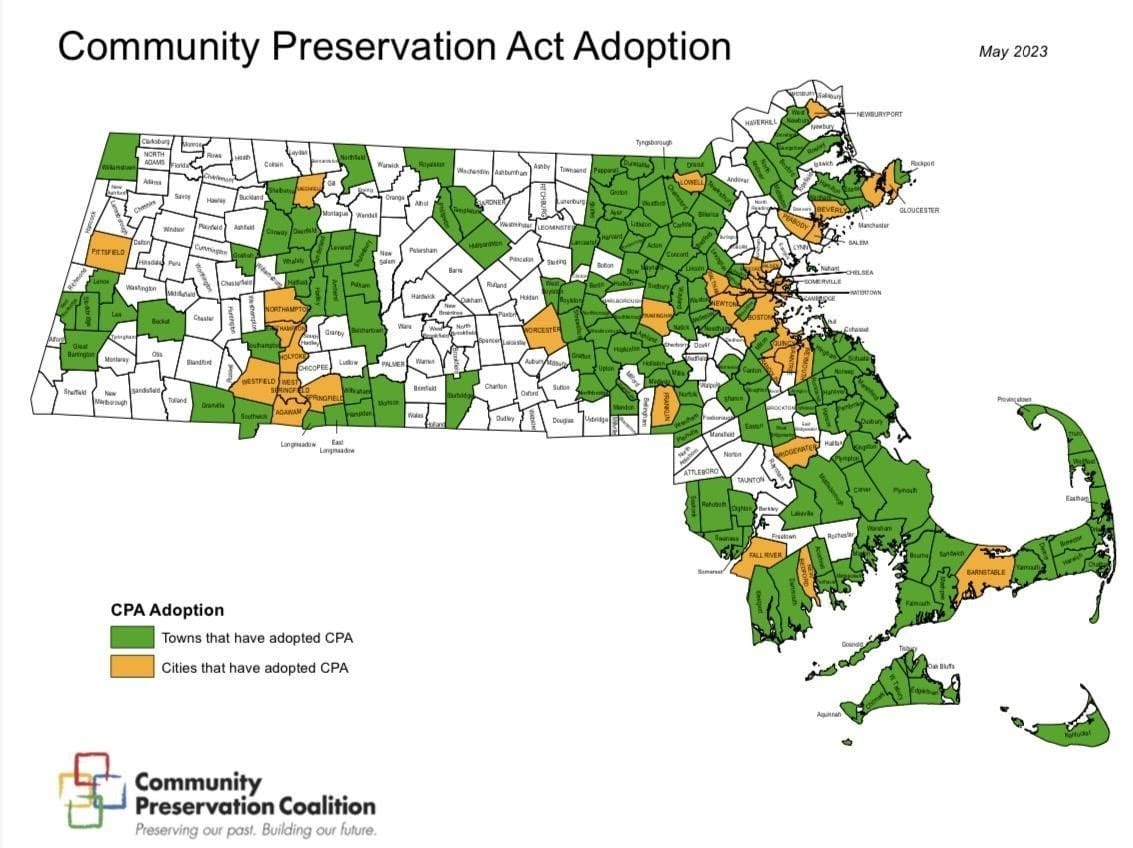

August 15, 2023. Did you know that 195 communities have passed the Community Preservation Act (CPA) to establish a real estate tax surcharge, but Winchester is not one of them?* The CPA was discussed at the Select Board meeting on August 14 where Select Board Member Mike Bettencourt gave a brief presentation about it. He said that he and Anthea Brady had formed a task force along with Winchester resident Jen Ryan (a member of the state’s Community Preservation Coalition Steering Committee), and Winchester Sustainability Director Ken Pruitt. On behalf of the task force Bettencourt asked the board to approve the creation of a 12-member study committee to prepare a report for Fall Town Meeting on the Community Preservation needs of the Town. The board approved the committee with the charge that they start public outreach this fall, report their findings to this fall’s Town Meeting, and have an agenda item on the Spring 2024 Town Meeting. If it passed at Town Meeting, it would be a ballot question in November of 2024.

As background, the CPA was signed into law in Massachusetts in September of 2000. It is a tool that helps communities preserve open space and historical sites, create affordable housing and develop outdoor recreational facilities (funds can be used to build and rehabilitate parks and playgrounds). The CPA must be adopted by ballot referendum. Before the CPA, there was no fixed funding source to preserve and improve a community’s character and quality of life. Now, 70% of Massachusetts residents live in a CPA community.

The adoption of the CPA allows communities to create a Community Preservation Fund for which monies are raised locally through the imposition of a surcharge of not more than 3% of the tax levy against real property. This surcharge does not raise the tax rate for the adopting community, but it assesses a surcharge on property tax bills after they have been calculated based on the community’s current tax rate. The law also allows for optional exemptions to be employed, such as (but not limited to) exempting those who would qualify for low-income housing, low to moderate income senior housing and subtracting the first $100,000 in property value. Bettencourt said he’d expect to ask for a 1 to 1.5% surcharge, rather than the highest amount of 3%.

Each CPA community also creates a Community Preservation Committee (CPC), which is a 5-to-9-member board that makes recommendations regarding CPA projects to the community’s legislative body.

The CPA statute also creates a statewide fund administered by the Department of Revenue (DOR), the Community Preservation Trust Fund (CPTF). As an incentive to pass the CPA, the CPTF provides annual distributions to communities which have adopted the CPA.

To read the full text of the law visit: https://malegislature.gov/Laws/GeneralLaws/PartI/TitleVII/Chapter44B

For a reliable source of information regarding the CPA visit: https://www.communitypreservation.org/

Tara Hughes is the President of Winchester News Group and a Precinct 1 Town Meeting Member.

*An Article (Article 5) was in the Warrant/Motion Book for 2022 Fall Town Meeting, due to a citizen petition, asking Town Meeting Members to vote to approve the CPA and stated terms and place it on the ballot for the voters in the March 2023 Town Election. It did not pass. The intent is to put it on the agenda for the Spring 2024 Town Meeting. If it passes, it will be placed on the Fall 2024 General Election ballot for the community to decide.